Financial Sector Signals Rising Investment in Identity Verification: Trust Becomes the Next Layer of Cyber Defense

As the digital economy accelerates and artificial intelligence reshapes how organizations operate, one critical area has emerged as the next frontier of defense: identity verification. Banks, fintechs, and cryptocurrency platforms are leading a global movement to bolster fraud prevention and digital trust, investing heavily in technologies that can distinguish legitimate users from increasingly sophisticated impostors.

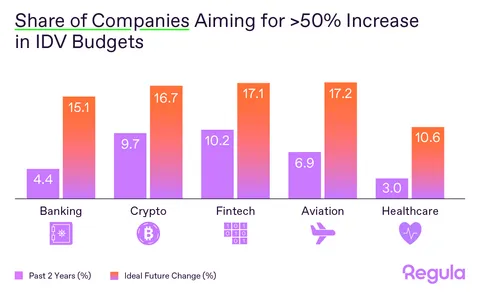

A new global survey from Regula, titled The Future of Identity Verification: 5 Threats and 5 Opportunities, reveals that this transformation is happening at a historic pace. In the banking industry alone, the share of institutions planning to increase their identity verification (IDV) budgets by more than 50% has nearly tripled—from just 4.4% two years ago to an anticipated 15% today. It marks one of the most rapid and widespread financial responses to technological risk in the last decade.

This surge in IDV investment underscores how the concept of identity has evolved. Once viewed primarily as a compliance formality or a security add-on, identity verification has become the backbone of digital trust. Whether it’s combating deepfake fraud, meeting global regulatory standards, or safeguarding the integrity of digital onboarding processes, IDV now sits at the core of enterprise strategy for financial institutions worldwide.

The Next Phase of Financial Defense

The financial sector has always been the first line of defense against fraud. However, the nature of that fraud is changing rapidly. With the proliferation of generative AI, malicious actors can now fabricate highly convincing identities—complete with lifelike facial biometrics, synthetic voices, and realistic identification documents. Deepfakes, once a novelty, have evolved into a commercial threat capable of deceiving even advanced detection systems.

According to Regula’s findings, this growing risk has prompted a wave of urgency across financial ecosystems. Nearly one-third of banks and crypto firms and one-fifth of fintechs expect to raise their IDV budgets by 10–20% over the next two years. Even more telling, about one in three organizations across the broader financial services ecosystem is preparing for increases in the range of 20–50%.

Meanwhile, the share of companies planning major budget hikes exceeding 50% has doubled across both the fintech and crypto sectors, with approximately 17% of organizations now committing to such aggressive spending. The result is a widespread recalibration of financial priorities—one where digital trust is becoming as essential as capital reserves or cybersecurity firewalls.

“Executives have finally woken up to the deepfake economy,” said Henry Patishman, Executive Vice President of Identity Verification Solutions at Regula. “They’re realizing that identity verification isn’t a cost of doing business anymore, but a growth engine. Just as cybersecurity became non-negotiable a decade ago, identity verification is now core infrastructure for trust in the AI era.”

From the Bank Vault to the Boardroom

Historically, identity verification was handled quietly by compliance teams and security officers—often regarded as a checkbox in regulatory audits or a back-office process. That perception is changing dramatically.

Regula’s survey indicates that C-suite executives are now taking direct ownership of identity verification strategy, integrating it into broader business planning. Nearly one in five global leaders now intends to increase their fraud prevention and IDV budgets by at least 50%, signaling a clear elevation of digital identity from an IT expenditure to a board-level priority.

This top-down shift is redefining how financial organizations measure resilience. Instead of viewing security and compliance as separate from customer experience, executives are now blending the two—recognizing that secure identity verification not only protects the organization but also builds confidence among clients and partners.

For digital banks and fintech startups, in particular, this perspective is vital. Customer acquisition and onboarding are the lifeblood of their growth models. By deploying advanced identity verification solutions—ranging from biometric authentication to document forensics—these companies are not just complying with regulations; they are strengthening their competitive edge by creating frictionless, trusted user experiences.

A Global Surge in Digital Trust Investment

The rise in IDV spending is not confined to any single geography. Regula’s survey paints a picture of a global race toward stronger digital identity infrastructure.

The United States leads the charge, with 22% of American companies targeting 50% or higher increases in IDV budgets—the largest proportion worldwide. The nation’s financial institutions, long accustomed to battling large-scale fraud and cyberattacks, are doubling down on identity-based defense mechanisms.

Meanwhile, emerging digital hubs in the United Arab Emirates, Singapore, and Germany are also showing remarkable momentum. Roughly a third of organizations in these markets are planning to increase their IDV budgets by 21–50%, driven by regional regulations such as the UAE’s growing digital economy strategy and Europe’s tightening AI and data protection frameworks.

The trend doesn’t stop with finance. Aviation companies are quickly following suit—about 17% of them now plan to raise their IDV spending by more than 50%, mirroring the financial sector’s urgency. Airlines and airports are increasingly reliant on biometrics for passenger identification and security clearance, making identity verification central to both safety and efficiency.

Even healthcare organizations, though more cautious, are joining the movement. Around 10% expect significant IDV budget increases, particularly as hospitals and insurers face new waves of digital fraud and data breaches involving patient records.

Across all industries, Regula’s report found that two-thirds of businesses have already increased their IDV investments, and nearly half are preparing for further double-digit growth. This marks a rare moment of cross-sector alignment, where identity verification is being recognized as a universal requirement of digital transformation.

Why Identity Verification Is Now Core Infrastructure

Behind these numbers lies a deeper shift in organizational mindset. Identity verification is no longer just a defensive tactic—it is becoming a foundational element of digital infrastructure.

Regula’s survey revealed that:

- 24% of companies now view IDV as the core of their trust management strategy.

- 27% aim to integrate identity verification across multiple departments, from fraud prevention and onboarding to marketing and customer support.

This evolution reflects the increasing interconnectedness of business operations in the AI-driven economy. When automation and data intelligence permeate every process—from customer acquisition to payment authorization—the risk of identity fraud multiplies. As a result, organizations are reimagining IDV not merely as a gatekeeper but as the glue that binds security, compliance, and customer trust together.

Moreover, the cost of weak identity controls is skyrocketing. Regulatory fines for data breaches or Know-Your-Customer (KYC) failures can reach millions, while reputational damage can erode years of brand equity overnight. For banks and fintechs competing on consumer trust, even a single instance of compromised verification can have long-term consequences.

This is why identity verification is increasingly viewed as a trust infrastructure challenge—akin to building secure digital roads and bridges for the financial economy. The modern enterprise cannot scale safely without ensuring that every digital interaction, transaction, and onboarding step begins with verified trust.

Deepfake Fraud and the AI Reality Check

The rise of deepfake technology is one of the most urgent catalysts behind this investment wave. Using generative AI, fraudsters can now fabricate hyper-realistic human likenesses—videos, voices, and identification documents—that are almost impossible to distinguish from genuine ones without advanced forensics.

In 2023 alone, several high-profile incidents demonstrated how deepfakes could be used to deceive identity systems. Criminals have impersonated executives in video calls to authorize fraudulent wire transfers and have manipulated synthetic ID documents to pass onboarding checks at financial platforms.

To counter these threats, institutions are deploying a new generation of AI-enhanced verification tools. These systems leverage machine learning, biometric liveness detection, and document authenticity analysis to detect subtle anomalies—such as inconsistencies in pixel patterns, unnatural motion, or micro-text variations on ID cards. In essence, AI is now being used to fight AI.

“Fraud prevention is no longer a game of catching up—it’s an arms race,” said Patishman. “The companies that invest now in layered identity verification will be the ones who stay ahead of synthetic fraud and retain the trust of their customers.”

Compliance, Risk, and the Trust Dividend

Beyond fraud mitigation, identity verification plays a crucial role in compliance. Financial institutions are under increasing pressure to meet Know Your Customer (KYC), Anti-Money Laundering (AML), and Counter-Terrorist Financing (CTF) standards that require rigorous identity checks.

As regulators around the world tighten scrutiny—especially on fintechs and crypto platforms—strong IDV systems have become a prerequisite for market access. However, companies that view compliance purely as a legal obligation are missing the bigger opportunity.

By integrating IDV into customer engagement and lifecycle management, organizations can unlock what many experts call the “trust dividend.” This refers to the competitive advantage that comes from being perceived as secure, transparent, and user-friendly. When customers know their identities are protected, they are more likely to transact, invest, and remain loyal to the brand.

Fintech leaders are particularly attuned to this effect. Many are embedding IDV seamlessly into their digital experiences—allowing users to verify themselves through intuitive biometric scans or document uploads without interrupting their journey. The goal is to make trust invisible yet omnipresent.

About the Report

The Future of Identity Verification: 5 Threats and 5 Opportunities is a global survey commissioned by Regula and conducted by Censuswide, a global market research consultancy, covering enterprises in the banking, fintech, aviation, healthcare, telecom, and crypto sectors. It explores how organizations are reallocating budgets, addressing deepfake-driven fraud, and building cohesive identity frameworks to support growth and compliance.

About Regula

Regula is a global developer of forensic devices and identity verification solutions. With our 30+ years of experience in forensic research and the most comprehensive library of document templates in the world, we create breakthrough technologies for document and biometric verification. Our hardware and software solutions allow over 1,000 organizations and 80 border control authorities globally to provide top-notch client service without compromising safety, security, or speed. Regula has been recognized in the 2025 Gartner® Magic Quadrant™ for Identity Verification.

Learn more at www.regulaforensics.com.

Source Link:https://www.businesswire.com/